Earlier this afternoon I was making myself a cup of tea and pulled out the sweet remnant of a  birthday gift, the empty tea tin of something wonderful and fruity that my girlfriend Jennifer had bought for me, for a couple of Sugar in the Raw packets and found $20 I had stashed in there at some (unremembered) point in the past. This seemingly mundane discovery reminded me of the recent mother lodes of gold coins found in California, Israel and those of the Staffordshire – buried treasures of the American Gold Rush as well as Iron and

birthday gift, the empty tea tin of something wonderful and fruity that my girlfriend Jennifer had bought for me, for a couple of Sugar in the Raw packets and found $20 I had stashed in there at some (unremembered) point in the past. This seemingly mundane discovery reminded me of the recent mother lodes of gold coins found in California, Israel and those of the Staffordshire – buried treasures of the American Gold Rush as well as Iron and  Middle Age era ‘safety deposit boxes’. What we trust, insofar as currency for transactions, has certainly evolved over the course of human history.

Middle Age era ‘safety deposit boxes’. What we trust, insofar as currency for transactions, has certainly evolved over the course of human history.

The creation of new currencies, or protecting assets and still making them available to their owners, most notably rests with The Knights Templar. Their efficient network and managed holdings ultimately created such wealth, and jealousy and covetousness as to foster the political intrigue between Philip IV of France and Pope Clement V resulting in their condemnation, and destruction to allow the ‘legitimate’ confiscation said assets. Our modern banking system might have been modelled on The Templars but 1000 years on, it’s time for innovation and to cast off the shackles (and fees, and bloated salaries) that come with what has become conventional and its resulting hotbed of resentment.

A brilliant, passionate man I met, (virtually within the dynamic social entrepreneurial world of which I am part), Shaun Frankson works for The Plastic Bank (title: The Dot Connector). The truth is I promised Shaun months ago (sorry for the delay!!) I would write about their ground-breaking efforts in monetizing Ocean Bound Plastic waste, in fact The Plastic Bank is the only organization on a global basis to do such, (please also sign their petition)  . What’s so impressive to me is how their efforts aim to solve catastrophic environmental issues simultaneously with raising up the world’s disadvantaged populations by collecting and trading in plastic waste as a currency – hidden treasure indeed. The Plastic Bank has had some recent successes worth mentioning as synopsised in this post to Shaun’s Facebook wall on 25 February (but not yet found in Google’s news feed): “2 countries, 3 cities, 8 meetings, 8 flights, 1 historic train trip, and 20,000 ton of social plastic… Mission accomplished.” What did that net? The Plastic Bank is now only months away from making plastic waste a bona fide currency in Latin America during Q2 2014!

. What’s so impressive to me is how their efforts aim to solve catastrophic environmental issues simultaneously with raising up the world’s disadvantaged populations by collecting and trading in plastic waste as a currency – hidden treasure indeed. The Plastic Bank has had some recent successes worth mentioning as synopsised in this post to Shaun’s Facebook wall on 25 February (but not yet found in Google’s news feed): “2 countries, 3 cities, 8 meetings, 8 flights, 1 historic train trip, and 20,000 ton of social plastic… Mission accomplished.” What did that net? The Plastic Bank is now only months away from making plastic waste a bona fide currency in Latin America during Q2 2014!

While I am on the subject of “plastic currency” I can only hope that all this innovative thinking leads to a deal with Innovia Security. The Bank of England just announced it will spend 1 billion Gbps  ($1.67 billion USD) over the next decade on materials and printing of its new banknotes and the integration of Ocean Bound Waste (OBW is intercepted rather than reclaimed from the oceans’ various gyres, let’s hope that it is in the future) as the raw material used to create the polymer substrate in printing currencies, currently in 23 countries, would have incalculable positive impact in the eradication of poverty as well as the mitigation of environmental pollution; two very different types of currencies each servicing its unique population.

($1.67 billion USD) over the next decade on materials and printing of its new banknotes and the integration of Ocean Bound Waste (OBW is intercepted rather than reclaimed from the oceans’ various gyres, let’s hope that it is in the future) as the raw material used to create the polymer substrate in printing currencies, currently in 23 countries, would have incalculable positive impact in the eradication of poverty as well as the mitigation of environmental pollution; two very different types of currencies each servicing its unique population.

While innovators are realigning our core values and responsibility to the planet (and hat’s off for the positive start but) San Francisco is currently only concerned with single serve plastic bottles of water yet hasn’t banned any other beverages (maybe the beverage industry successfully blocked the inclusion of soda and juice and milk – again?). Redemption monies from bottle bill legislation serve as a currency of sorts for the urban impoverished across America and Canada, still all plastic bottles and containers have not earned the distinction of 5cents (or 10cents) per to ensure recycling. Why? (More on that particular rant in the future, I promise.)

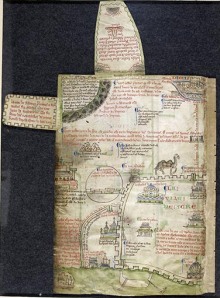

Matthew Paris, maps from the Historia Anglorum and Chronica Maiora, St Albans, c. 1250.

Route-Map to the Holy Land

The St Albans monk Matthew Paris (died 1259) never made the journey to the Holy Land. He did however draw a fascinating map of the pilgrimage route from England to Jerusalem. The route begins in London and progresses from the bottom to the top of each page. The final destination is the Holy Land depicted on two leaves.

I have been dealing with things tangible, that any one of us can hold in our hand, from grocery bags and plastic containers, to currency made from the same polymers – what about the intangibles? When Medieval pilgrims to the Holy Land first put their trust in The Knights Templar to ease the stress over carrying the funds necessary to make such a journey and for protection it was with the blessing of the Pope in Rome, faith notwithstanding trust was implicit and quite literally sacred. There wasn’t profit involved as usury was considered a sin:

…though he be a stranger, or a sojourner; that he may live with thee. Take thou no usury of him, or increase: but fear thy God; that thy brother may live with thee. Thou shalt not give him thy money upon usury, nor lend him thy victuals for increase (Leviticus 25:35-37).

So monies were deposited with the Good Knights and the same monies were returned (using those funds in the meantime to offer loans at interest to sovereigns who overspent was something else).

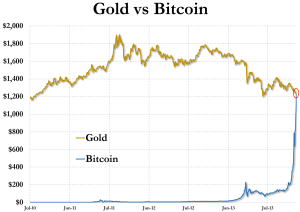

The Greater San Francisco Bay area has been host to technological innovation since 1939, anyone using a computer should know the story of William Hewlett and David Packard, but no one REALLY KNOWS exactly who is behind the brilliant currency innovation known as  Bitcoin. While Bitcoin’s buried treasure is worth about the same amount as the gold coins in the buried Californian tincan should the $9m USD in value harddrive be found in a hundred years’ time will the digital code supporting it still exist? Because while any innovation in currency deals with hiccups (and thefts and counterfeiting) as well as the means to protect those assets we are moving forward so fast and away from traditional, and even digital currencies, that it’s hard to grasp how humankind will ultimately conduct its transactions in even five years time.

Bitcoin. While Bitcoin’s buried treasure is worth about the same amount as the gold coins in the buried Californian tincan should the $9m USD in value harddrive be found in a hundred years’ time will the digital code supporting it still exist? Because while any innovation in currency deals with hiccups (and thefts and counterfeiting) as well as the means to protect those assets we are moving forward so fast and away from traditional, and even digital currencies, that it’s hard to grasp how humankind will ultimately conduct its transactions in even five years time.

In the meantime, in global terms, there are 4 billion people who live on less than $2.50 USD per day – surely the contemporary equivalent of Medieval pilgrims to the Holy Land where innovation and trust platforms are critical. Clearly the likes of JP Morgan (net income for the fourth quarter of 2013 of $5.3 billion) are not going to service those earning such insignificant amounts (even as their greenwashing efforts for WaterAid ease the conscience (?) of those top 100 London based JP Morgan top earners gaining average of £2m each in 2012 and Goldman Sachs disclosed its high flyers received £2.7m on average). Smart people have been tinkering around with servicing this underserved population for a couple of years with crowdfunding on low cost smart phones, but even policy wonks disagree is microfinance designed to raise people out of poverty or provide equal access to financial services? Why do they have to be mutually exclusive? And even experts agree that the success of Grameen Bank and its microfinancing model is 20 years old and ready for the next round of disruptions (or innovations). Forbes magazine (back in 2007) indicated that there were more than 12,000 microfinance institutions operating across the globe, 900 are currently registered with the Nigerian Central Bank alone.

Let me expand on the nominal introduction previously offered of Oradian.com because as I see it what they are doing is critical to the successful disruption of microfinance and could provide the bridge to both lift people out of poverty and provide financial services in due course. They are not an NGO, they are technology geeks – four CIOs actually – with a Software-as-a-Service (SaaS) model which has two distinct client bases, the institutions providing microfinance services and the end customer whose transaction is being processed; in other words they are “development tech” and very much like the actual Knights Templar both interfacing with the pilgrims as well as holding the assets (albeit very temporarily) on their trust platform – well over 100,000 transactions to date spread amongst their (current) three customers, not bad for a company that didn’t exist before June 2012. A two year contract with Development Exchange Centre (DEC) in Nigeria provides Oradian credibility, income and expansion of their client base much the way that Templar founders Godfrey of Bouillon and Hugues de Payens were able to grow in a mere nine years to having expansive holdings all over Europe and the Levant. We still are impacted by their decision to provide, protect and disrupt the status quo of the 12th century, and today four billion people stand to benefit from the disruptive efforts of The Plastic Bank and Oradian.

If you enjoy my blog please consider ‘buying me a cup of tea’ in your currency via PayPal to livelikeadog@gmail.com and do share it with your friends on Facebook, Google+ and Twitter – I am @TeresaFritschi. To order my book, please click on the cover art of my book below, thank you!